Bhuvan—China's utter dominance of global shipping

Warning: This is going to be a messier post than my usual.

In my previous post I wrote about China's industrial policy targeting its shipbuilding industry. China started focusing on building up its shipbuilding capabilities around 2000, and by 2010, it's market share had grown to over 50%. The estimates vary, but China today has a 60-70% market share in shipbuilding.

When you measure the outcome of China's investments and incentives in terms of sheer dominance of the shipbuilding industry, then the industry policy was a success. However, when you measure the success of the investments in terms of return on investment, the number is not just negative; it's a deeply negative 82%.

So what's China's endgame here?

It's important not to look at China's industrial policy for its shipbuilding industry in isolation. It's just one small part of its overall goal to expand and cement it's dominant position in global trade. China's intent to build up its maritime capabilities can be traced all the way back to the year 2000, in which it was admitted into the World Trade Organization (WTO).

Yet it was not U.S. companies being displaced by the rise of China's shipbuilding industry. Even when the U.S. shipbuilding industry was more vibrant in the 1970s, U.S. shipyards produced just 15 to 25 new merchant ships per year—typically accounting for less than 5 percent of global tonnage. After subsidies supporting the industry were eliminated in the 1980s, this number dropped to a fraction of 1 percent of global production.

Japanese and Korean shipbuilders have suffered the most from China's ascent. Over the past decade, the two powerhouses have seen their combined share of the global shipbuilding market tumble from 55 percent to about 40 percent today.

This trend will likely continue. Last year, China attracted 59 percent of new shipbuilding orders. Most large ocean-faring vessels put to sea in the coming decade will be built in China. — The Threat of China's Shipbuilding Empire

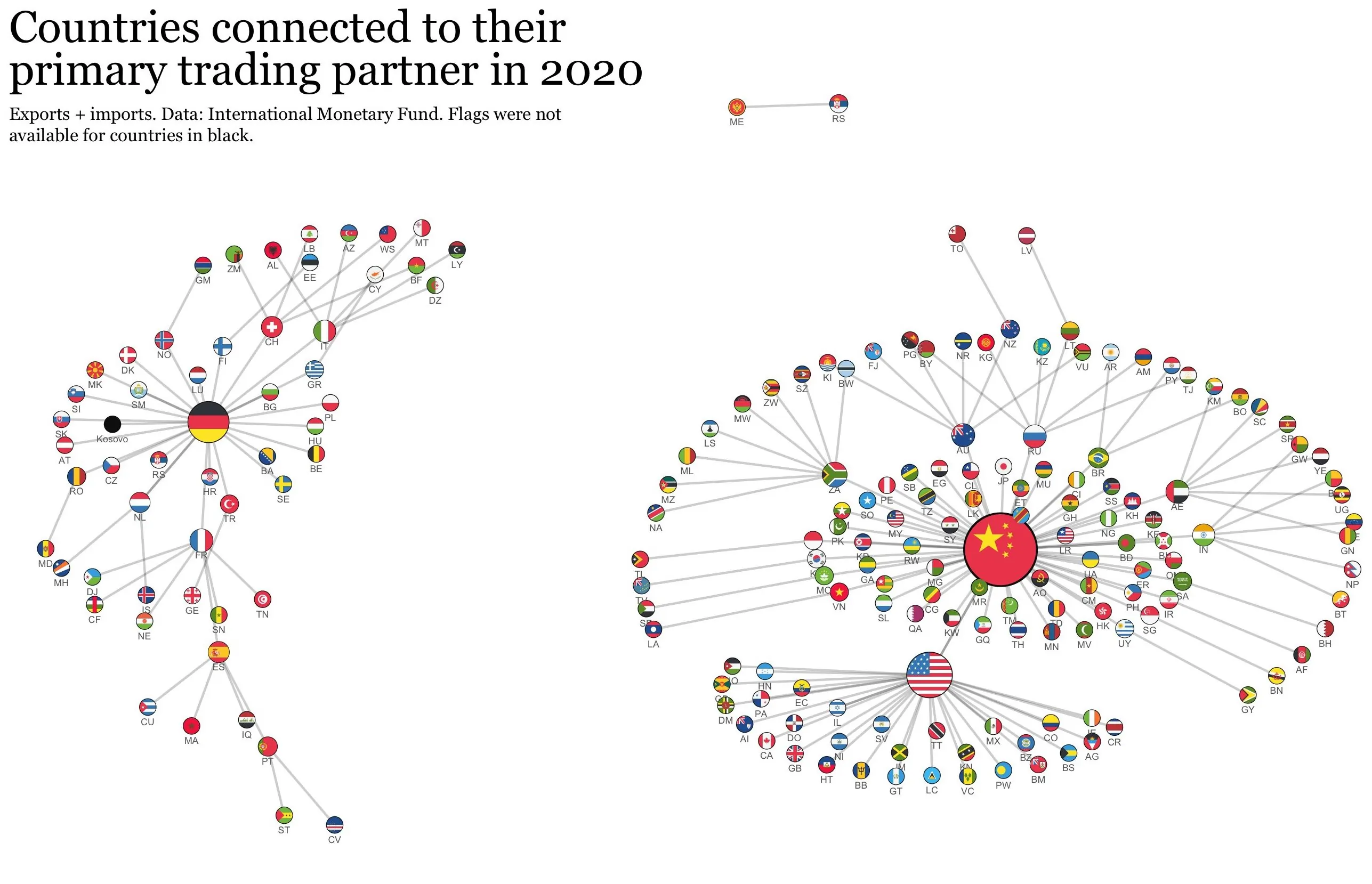

Here's a stat that makes this concrete. In 2000, the US was the top trading partner for 80% of countries around the world, including South America and Africa as a whole. That number is just 30% today. China is today the largest trading partner for over 120 countries. That's a stunning number, and all of this is in less than two decades.

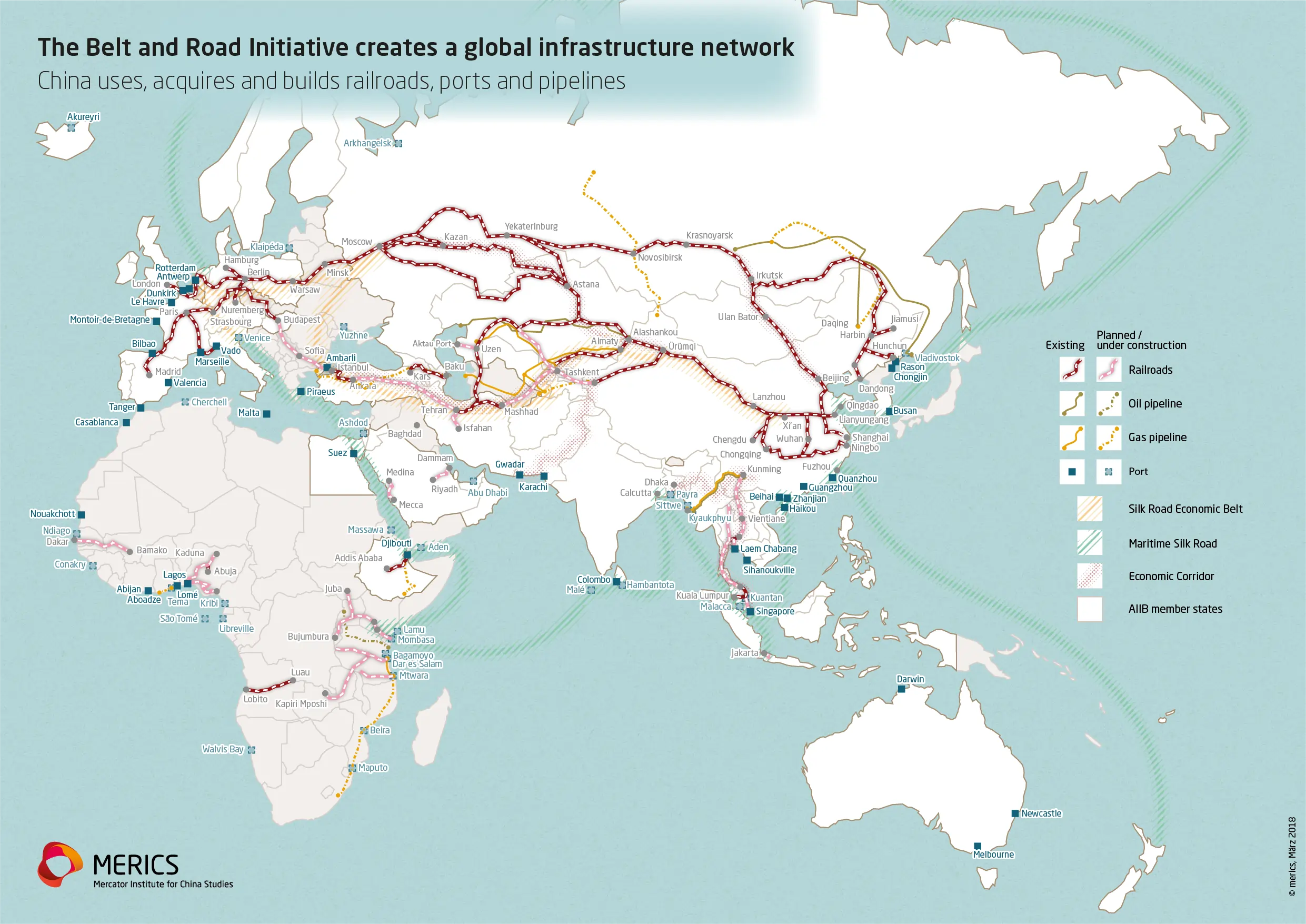

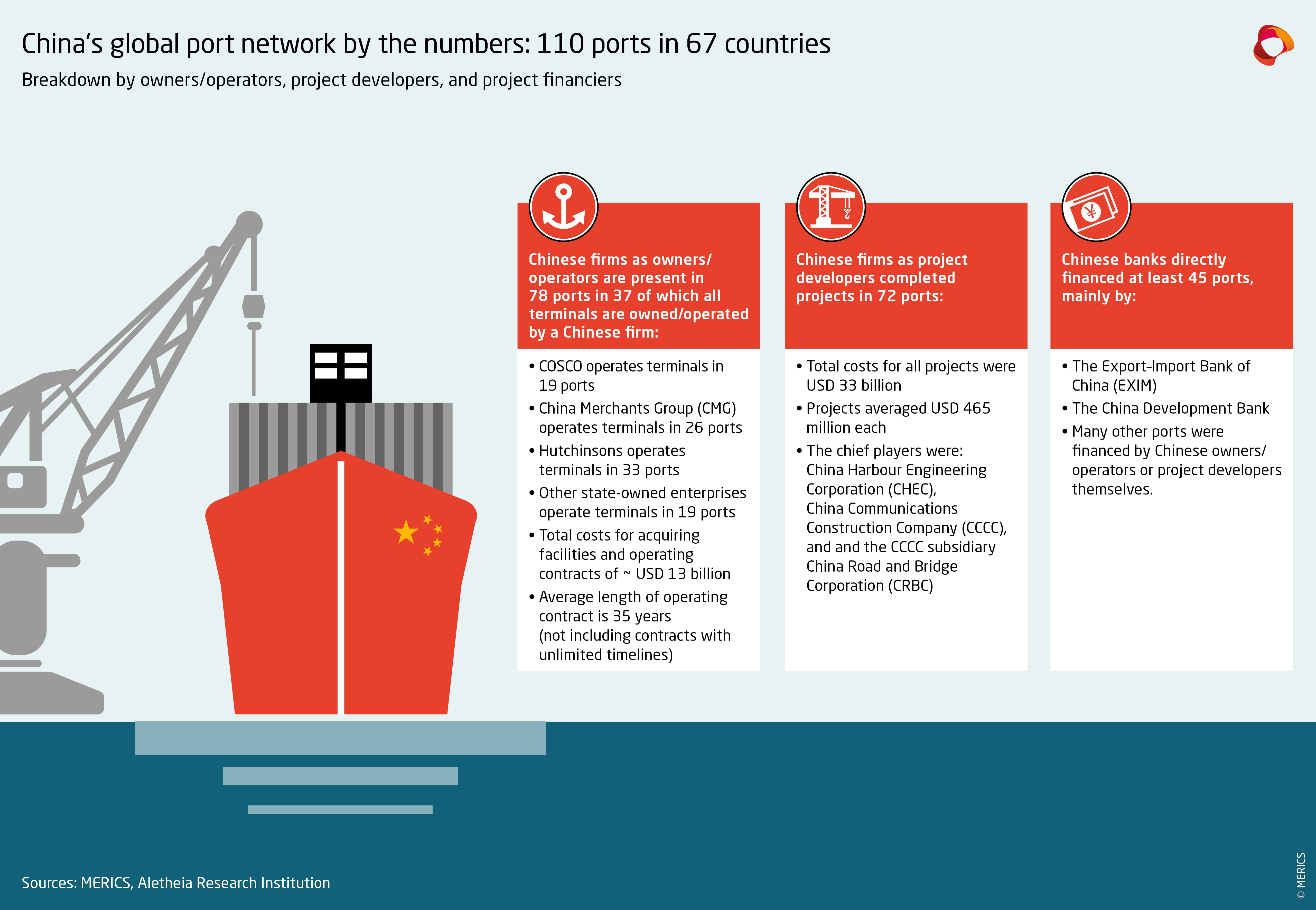

It's not just shipbuilding; over decades, Chinese companies have meticulously built ports around the world. In 2013, Xi Jinping announced the Belt and Road Initiative (BRI), also known as the One Belt One Road or Belt and Road Initiative. BRI was an investment and development initiative to connect Asia, Europe, Latin America, and Africa.

The program involved the construction of airports, ports, power plants, bridges, railways, roads, and telecommunications networks on a massive scale in countries that couldn't afford it.

The ultimate goal was to funnel business to Chinese infrastructure companies and at the same time create overseas captive markets for the growing manufacturing capacity of Chinese companies. Most of the infrastructure projects are almost always constructed by Chinese infrastructure companies. An estimated 89% of all contractors participating in BRI projects are Chinese companies.

The BRI had two components:

- The Silk Road Economic Belt: Overland routes for road and rail transportation through Central Asia

- The 21st Century Maritime Silk Road: Sea routes through Southeast Asia, South Asia, the Middle East, and Africa

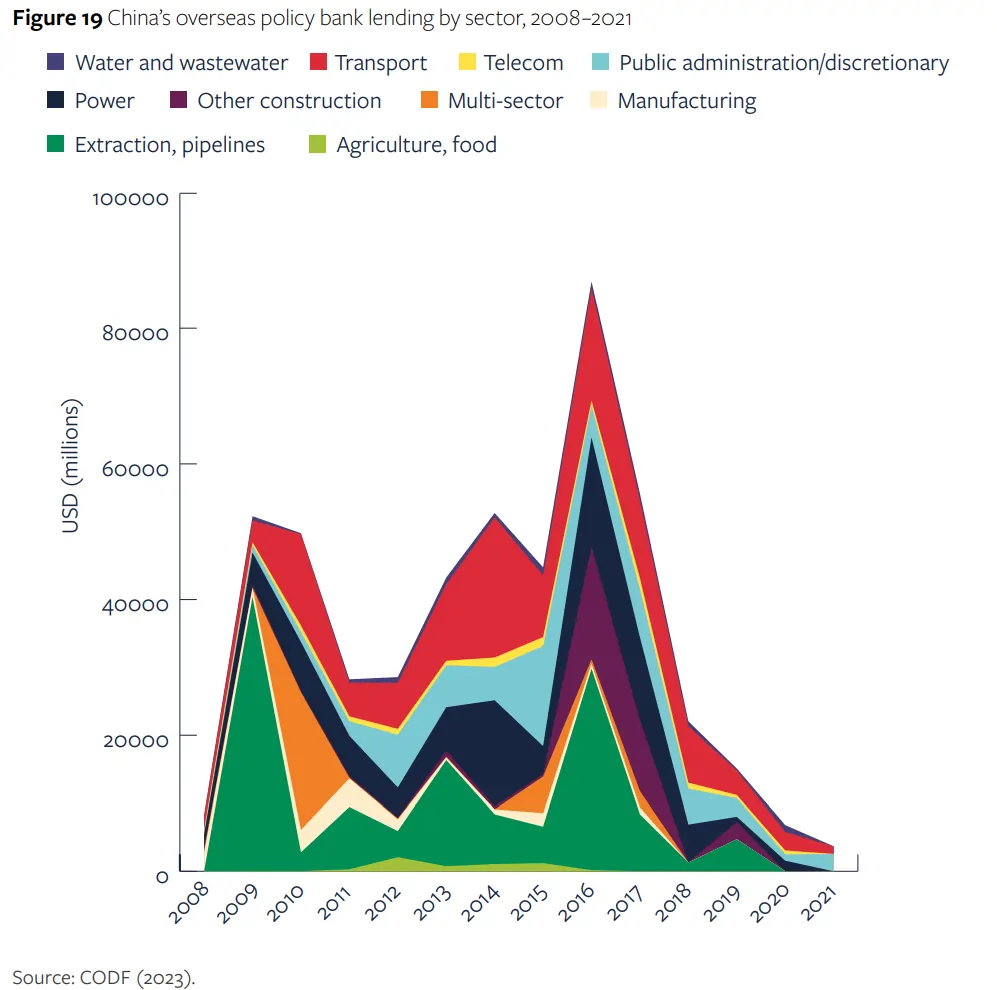

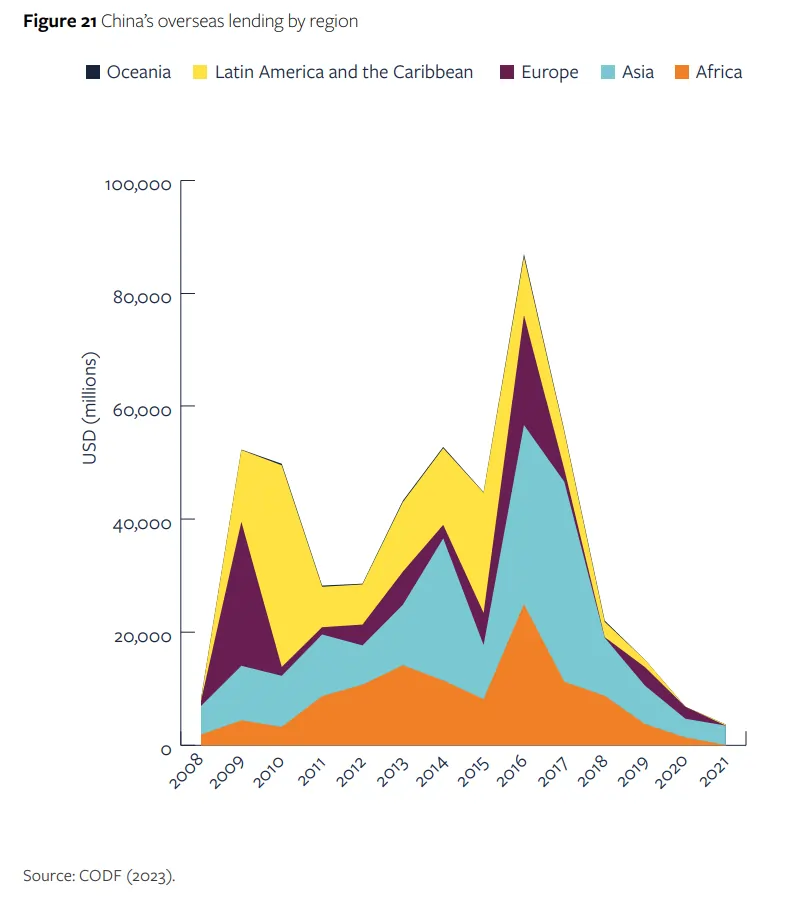

A few charts from ODI Global:

Accurate numbers aren't available, but China may have invested over $1 trillion overall in hundreds of countries. This led to accusations of BRI being a "debt trap." The Americans and Europeans argue that by knowingly investing in expensive projects in poor countries, China is trying to entrap poor countries to take over their strategic assets and extract political concessions.

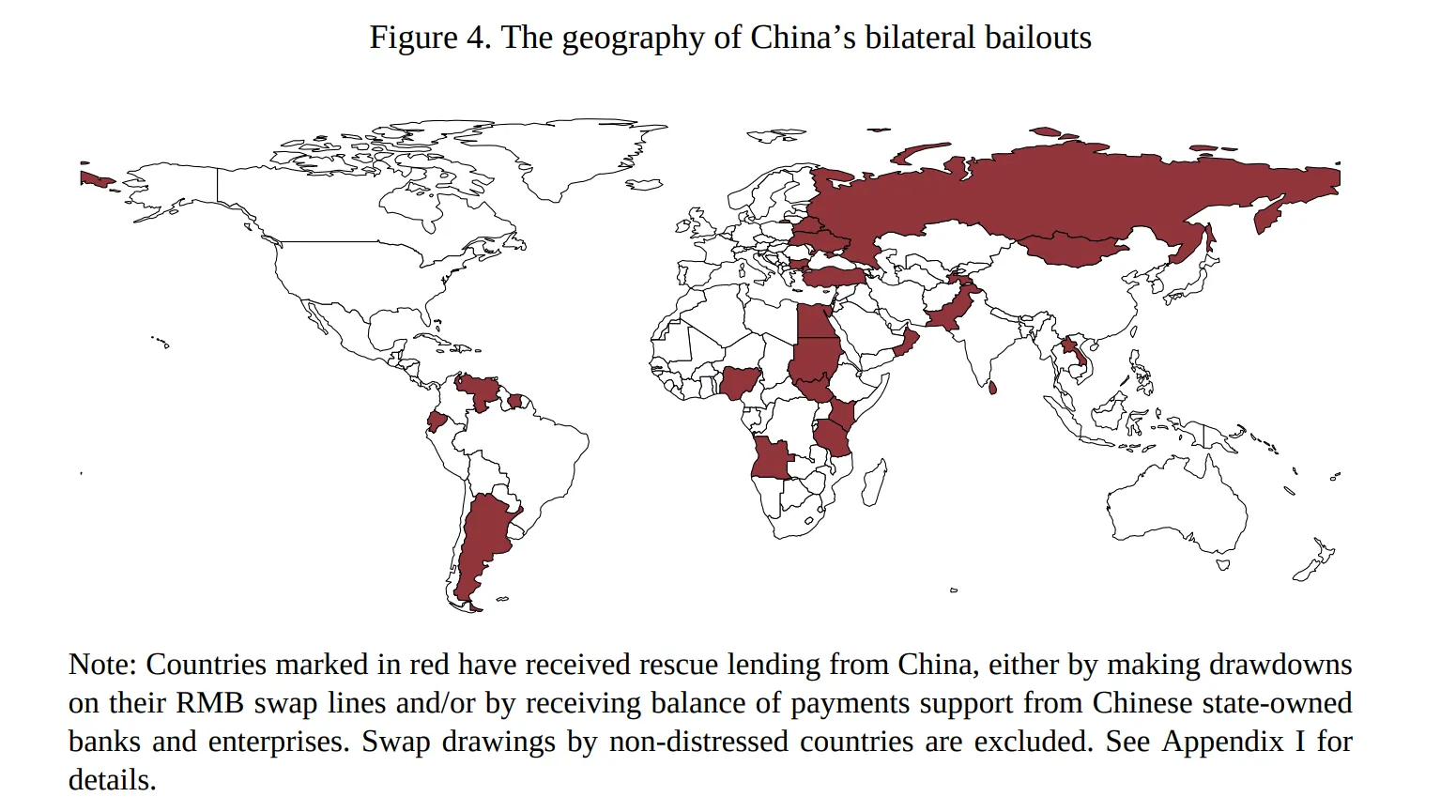

But these accusations make negative sense. If anything, China's lending strategy has been akin to that of a filthy rich drunk guy with a shitload of money to splurge. China often lends at commercial terms, but it's risk management has been terrible, to put it charitably. China has reportedly spent $240 billion on bailing out countries under debt distress arising from non-payment of loans linked to BRI projects.

Having learned the hard way not to lend like a drunk and crazy person, China has dramatically slowed down its overseas lending.

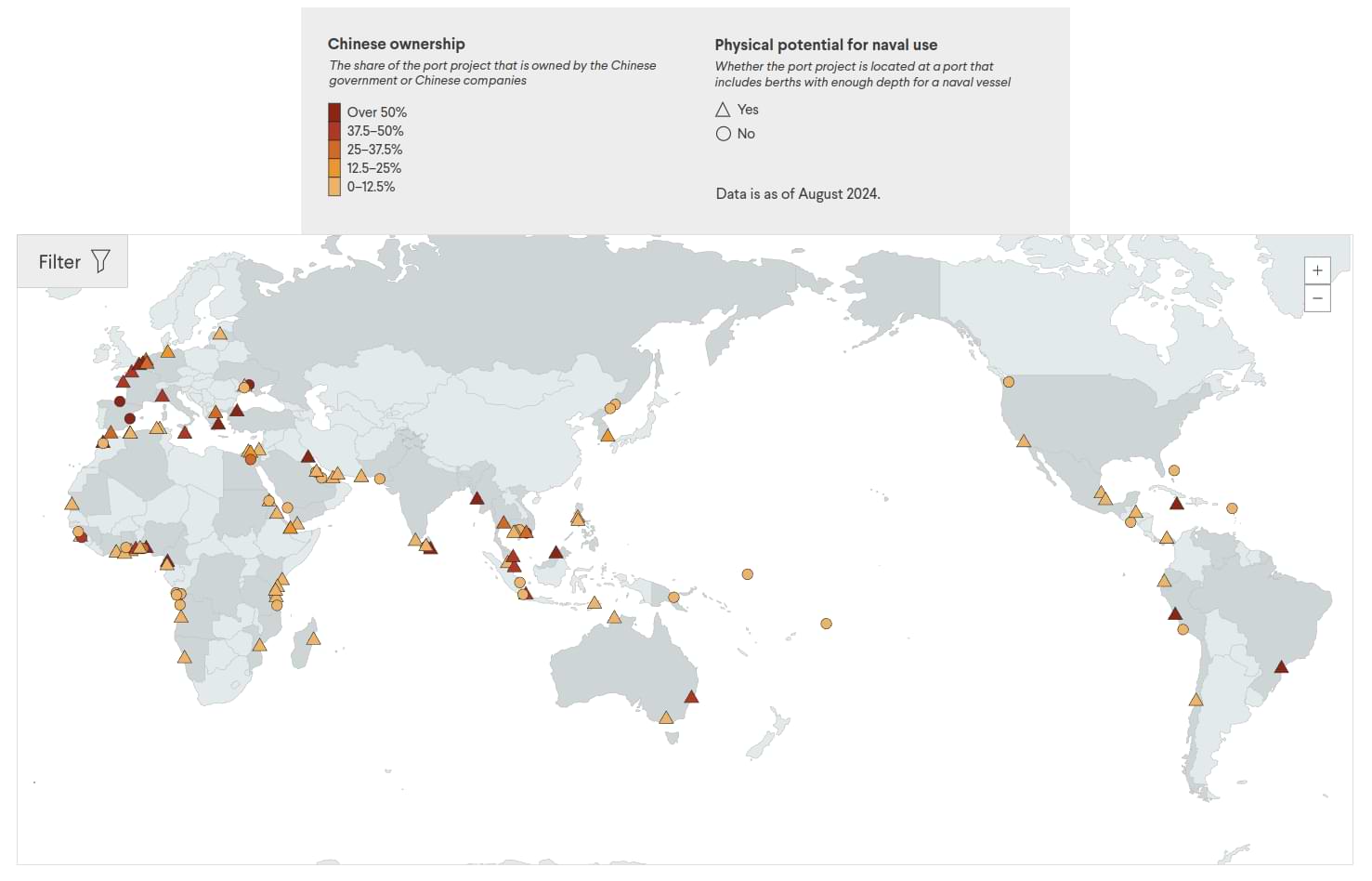

As part of its Maritime Silk Road strategy, China has built a string of ports that pretty much encircle the world. Chinese companies have varied degrees of ownership in 129 ports, of which 115 are active. Take a look at this map, and what China has managed is ridiculous in an impressive way:

So China dominates the entire value chain in terms of shipping, from building ships and ports to also operating them.

All of this is in service of one thing: creating a global market for it's goods, given that 95% of Chinese international trade is carried over the seas. When you look at China's "wasteful" investments in its shipbuilding industry from the perspective of creating overseas markets, it makes a lot of sense.

China's encircling of the world with ports has raised alarm bells among Washington's security establishment. The US is worried about China's growing influence in its backyard, like Latin America, and also whether these ports can double up as naval bases by the Chinese navy.

Nothing shows the worry more than the increasing number of reports and articles written by security think tanks like CSIS.

The West's criticism should be seen from the frame of them crying about both missing the opportunity to create markets for their companies and also earning political goodwill. Regardless of what you think about China, they offered a good deal: we'll build things and stay out of your politics. The West, with its moral grandstanding and virtue signaling, is incompatible with much of the world's. This is a particularly white people's conceit.

This isn't to say that China has always been welcome with open arms in Africa and Latin America. Its own narratives about what BRI is supposed to do is riddled with contradictions. Having said that, it's been brilliant at exploiting commercial opportunities than the West.

The Office of the United States Trade Representative (USTR) in January this year published a report on its investigation on China's strategy to dominate the shipping sector. A few stats:

- China increased shipbuilding market share from ~5% in 1999 to over 50% by 2023

- It controls 19.1% of world's commercial fleet

- Supplies 86% of intermodal chassis, 95% of shipping containers, and ~80% of US ship-to-shore cranes

- In Q1 2024, China collected nearly 76% of new shipbuilding orders globally

- Chinese firms own stakes in or operate terminals at 96 overseas ports, 36 of which are among world's top 100 ports

- According to Clarksons Research, as of Aug. 12, 2024, Chinese shipyards have won:

- 90% of global contracts for container ships

- 83% of global contracts for bulk carriers

- 72% of global contracts for tankers

- 49% of global contracts for offshore platforms and equipment

Cry me a river:

"Today, the U.S. ranks 19th in the world in commercial shipbuilding, and we build less than 5 ships each year, while the PRC is building more than 1,700 ships. In 1975, the United States ranked number one, and we were building more than 70 ships a year," Ambassador Katherine Tai said. "Beijing's targeted dominance of these sectors undermines fair, market-oriented competition, increases economic security risks, and is the greatest barrier to revitalization of U.S. industries, as well as the communities that rely on them. These findings under Section 301 set the stage for urgent action to invest in America and strengthen our supply chains."

Pranav—Why is Mao so revered in China?

He clearly seems like a rampant psychopath who wrecked most of his country’s political and economic systems. The Chinese themselves seem to understand this fact—they were the worst victims of his atrocities, and there’s enough evidence that they do criticise him often. Not easily, and not publicly, but it isn’t as though China’s a country of a billion idiots that are chill with the decimation of millions of their compatriots. This Reddit thread has some good perspectives.

Anyway, the brilliant, hilarious, incredible (and really, you could dump the whole thesaurus here, because she’s so, so good!) Sarah Paine talked about Mao’s life and legacy on Dwarkesh’s YouTube channel. And while she’s no fan of his, she does convey a sense of why Chinese feelings on the matter are complex.

Here’s what I learned:

Mao reunited China: The Chinese are a proud people. Their civilisation has always prioritized education and achievement, and that has kept it ahead of the rest of the world for centuries. Since 1911, though, China had been living under anarchy—torn up into pieces by warlords. In uniting China, Mao restored Chinese pride. Think of the war-torn parts of today's world. Don't they look hopeless? Doesn't finding an end to their quagmire feel impossible? Mao pulled it off—across one of the largest land masses on Earth.

Mao initially looked like a Robin Hood figure: Mao started from a place of having no power at all. How did he get power? He began by winning hearts. His communist faction began by doing social work, which would then be heavily propagandised. In the early days, then, he would have looked like a saint—the one man in China that was helping people when everyone else was bent on killing them. That image perhaps stuck on even after the proved otherwise.

Mao was a data wizard: Mao was successful because he understood China at a time when nobody else did. He collected tremendous amounts of data—his entire communist faction was an elaborate data-collection machine. And he was skilled at interpreting data. It was thus that he understood the untapped political power of the peasantry—they made up 80% of the population but owned very little of the land. It is thus that he began recruiting women for his cause. He also courted minorities like the Uighurs when nobody would touch them. He eventually rode all their resentment into power.

She also holds that he was perhaps the most prolific psychopath in history.

But at least I now get why some people—wrapped in the blinders of their times—might revere him.

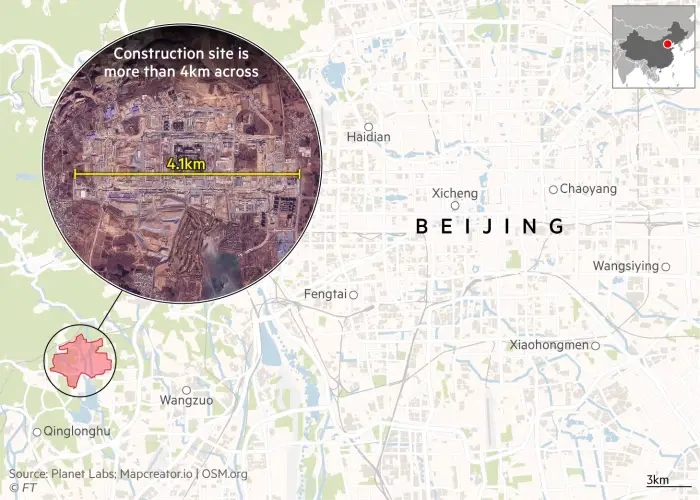

Tharun—China is building a military base ten times the size of the Pentagon

China's military is building a massive military base, a construction site spanning roughly 1500 acres. Rumors suggest they are planning on building large bunkers to protect their leaders in case of conflict, including a nuclear war.

Speaking of nuclear capabilities, China is rapidly expanding its arsenal. In just one year, they've increased their operational nuclear warheads from 500 to 600. But that's not all—President Xi Jinping has also ordered the PLA to develop the capability to attack Taiwan simultaneously.

This focus on Taiwan is particularly concerning when you consider Taiwan's critical role in global technology. Taiwan isn't just another island—it's the center of global semiconductor production. It's not just a place with factories; it has a whole setup needed to make chips. This includes highly skilled workers, a network of specialized suppliers, and infrastructure that provides everything from precision tools to materials. While other countries are trying to build similar facilities, recreating this ecosystem from scratch is extremely difficult.

If China were to invade Taiwan, this entire ecosystem would be at risk. The impact would be devastating. Think about what happened in 2021 with the chip shortage—car production stopped, consumer electronics were hard to find, and the global economy lost around $240 billion in GDP. Now imagine that situation but on an even larger scale. The disruption wouldn't just affect gadgets; it would impact national defense, medical equipment, communications, and essential infrastructure worldwide. This is why the U.S. and its allies are working to spread out semiconductor production by investing in new facilities in places like the United States, Japan, and South Korea.

We have done an entire episode on the global chip war on The Daily Brief, which you can find here.

Of course, the Chinese embassy in the US responded with vague assurances, saying they only want peaceful development. But can you really trust such statements? Only time will tell.

Krishna—Efficient markets

I was doing some research for a show we have on Markets called *Who Said What*, and the host is yours truly. Bhuvan had sent me an article by Aswath Damodaran where he was talking about active vs. passive investing. While reading more on it, this term—markets are efficient—kept popping up. It’s not like I haven’t heard the term before, but I never really knew what it meant.

Here’s what it means in plain, vanilla terms:

Imagine you go to a sabzi mandi with many vendors selling the same vegetables. You want to buy 1 kg of tomatoes. If one vendor is charging too much, you’ll just go to another. Over time, vendors realize they can’t overcharge because customers will simply switch, so prices become standardized.

Stock markets work the same way. There are thousands of buyers and sellers. If a stock is too cheap, investors quickly buy it, pushing the price up. If it’s overpriced, they sell, bringing the price down. This constant buying and selling means prices usually reflect the true value of a stock, based on all the information available. That’s what people mean when they say markets are efficient.

So the next time someone says it, you can, like me, confidently bullshit your way through the conversation. 🙂

That's it for today. If you liked this, give us a shout by tagging us on Twitter.