Pranav—Understanding India's economic history

Today, I'm resuming the Doug Irwin paper I've been going through for more than a week. I'm sorry, I learn slow.

Anyway, as usual, here are my notes peppered with plenty of my own commentary. A word of warning, though — I'm basically replicating the whole paper here. To tell you the truth, all of this seems like crucial context, at least as someone with a very hazy understanding of India's economic history:

By the 1980s, India was clearly falling behind its peers. This is an under-rated point — one reason there was no strong impulse for reform before this was a simple lack of counter-examples across the world. The old lot of countries had been rich for too long to compare ourselves against. And countries that became independent along with us hadn't pulled ahead yet. You could convincingly make the case that this is the best that a poor, underdeveloped country can achieve. When the East Asian tigers kicked into high gear, however, this became a harder argument to make.

The counter-factual really wasn't obvious — the way it currently isn't.

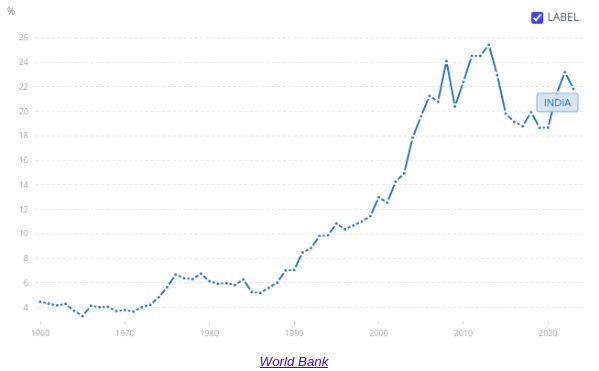

- In the 1980s, we didn't think we were capable of high exports. After all, exports were a mere 5-7% of our GDP, and we didn't see a universe where we could do better. With that sort of pessimism, reform did not make sense.

- If you truly believe that India has some sort of racial or civilisational disadvantage, and that if we compete internationally, we'll get smacked by our betters, a cumbersome and paranoid forex-management regime makes sense. But look at the graph below, and it's obvious — the problem wasn't in our genes or our culture. It was in our policies.

By this time, however, there's a clear constituency for reform — most surprisingly, in the bureaucracy itself. Manmohan Singh and Jagdish Bhagwati had been making the case for decades, but Irwin points to many other such views:

- For a long time, the prescriptions for reform were timid. We were swimming in the kiddie pool, trying to tinker with the import licensing system in the hope that something falls in place.

- By the late '80s, however, there were far stronger voices in favour of liberalisation. Former RBI governor IG Patel, writing in the late '80s, asked for a "virtual bonfire of the industrial licensing system", and expressed hope that it would be torn down, if not for reasons of economic efficiency, then because it was much too tainted by corruption.

- It's interesting that neither civil society, nor academia, nor politicians were leading this charge. Somehow, everyday politics seems terrible at pushing for good economic policy. I'm not sure why. Is it just economic illiteracy, or is there something deeper? Is a science of scarcity simply incompatible with a game of jockeying for resources?

Rajiv Gandhi himself, after his landmark 1984 victory, decried India's autarkic inclinations. But when it came to the real work of reform, he did not deliver.

- All he managed were small, incremental modifications. The old guard, sadly, hated his market-friendly ideas, and he was too phattu (in the words of Sacred Games) to push through regardless.

- He did relax import restrictions significantly. He expanded the 'OGL list' (that's 'open general license', which allowed you to import goods without restrictions) from 79 capital goods to 1170 capital goods and 949 intermediate goods. But this wasn't an overhaul — it was merely the relaxation of a fairly terrible system.

- Combined with the greater permissiveness with imports, however, was a massive fiscal expansion. Inflation went up, and the Rupee became increasingly overvalued. The black market premium on forex transactions inched up to 30% by the late 1980s. The government, too, was running on high fiscal deficits. We were primed for a balance of payments crisis.

- To bring more revenue in, the government turned to tariffs. By 1990, India had one of the worst tariff rates in the world, with the highest slab of tariffs at 355%. The import-weighted average tariff rate was 87%. For context, America's Smoot-Hawley era rate was under 20%, and that wrecked the global economy.

The one redeeming grace of the Rajiv Gandhi years? He hired technocratic economists into the government as advisors. These were reform-oriented folks with a background at the IMF or World Bank.

- These guys did not have the buy-in of the entire government. The old guard saw them as elitist outsiders with no concern for the poor.

- Moreover, Indian academia, too, did not see the issues in our way of doing things. They over-indexed on the importance of import controls as a way to support domestic industry, or to help with our balance of payments struggles.

In 1989, the World Bank commented that general intentions for reforms had not born fruit, because they weren't coded into concrete policy prescriptions. This was a gap it sought to fill.

- It therefore presented a roadmap for reform: (a) remove quantitative import restrictions on manufacturing goods within two years, and (b) simplify the tariff structure and slash tariffs.

- It rubbished the argument that easing import controls would expand imports. Moreover, the right policy solution for an increase in imports was a change in the exchange rate.

One of India's technocratic heroes — a Rajiv Gandhi-era hire — was Montek Singh Ahluwalia.

- He came in with an incredible CV. Rhodes Scholar, Oxford MPhil, Work Bank pedigree - the works. By the time he came into the Indian government, he had seen enough of the world to be convinced of the importance of liberalisation.

- In 1989, Rajiv Gandhi lost the general elections, and VP Singh became Prime Minister. As Prime Minister, Singh was impressed by Malaysia's rapid growth. Ahluwalia pointed that this was because Malaysia, unlike India, had the willpower to reform.

- And so, Singh asked Ahluwalia for an agenda for reform. Within a couple of months, the latter prepared one. This was a 34 page memorandum — "Towards a Restructuring of Industrial, Trade and Fiscal Policies" — also called the 'M Document'.

The M-Document was a game-changer:

- It contained five priorities: (a) improving macroeconomic policy, (b) modernising the public sector, (c) scaling back industrial licensing, (d) reducing protectionism for domestic industry, and (e) opening up to foreign investment. (From a quick look, we've missed the boat on (b), and occasionally flirt with reversing (c) and (d)).

- It drew a link between protectionism and poor export performance, and argued that protecting the domestic markets would limit our ability to export.

- It pushed for an abolition of the licensing regime and a shift to tariffs — that could slowly be scaled down. This would be done in a way that could ensure that (a) Indian industry wasn't wrecked (by altering the exchange rate), and (b) government revenues weren't affected (by moving to different taxes).

- In the short term, balance-of-payments issues could be corrected by giving import credits to exporting firms, which were freely tradeable. This was a far more flexible approach than what the government did at the time.

- The whole thing hinged on a new macroeconomic approach. Without that, the whole system would fall apart.

- The M-document was also deeply controversial. Everyone saw problems in the document. The Commerce Ministry didn't want to give up control the Industries Ministry wanted domestic industry to stay protected, the Finance Ministry didn't want to shake up India's balance of payments, the Revenue Ministry feared losing revenue.

- And so, the M Document was shelved. At least for another year.

When Iraq invaded Kuwait the next year, everything changed:

- Global oil prices tripled. Remittances from Kuwait disappeared. The few exports we made to the Middle East paused.

- The result? A full-blown balance of payments crisis. India spent its foreign exchange to avert disaster, and soon burnt through them all. From $3.1 billion in August 1990, they were down to $896 million in January 1991. This was barely enough for two weeks of imports.

- VP Singh tried negotiating an IMF loan, but lost the confidence of the Parliament. Chandra Shekhar followed, and opposed IMF help. But other creditors weren't keen on lending to India. S&P downgraded India's credit rating. Things were getting desperate. We even tried a hare-brained scheme to get money from the Sultan of Brunei that fell apart.

- We also clamped down on imports — tightening licensing requirements and culling forex availability. In essence, all non-food, non-oil imports were stopped. But this regime of austerity hurt our output. Productivity fell, as did employment.

- India started selling its gold reserves to get by. This was deeply humiliating for Indians. A default was around the corner. Something had to change.

- Manmohan Singh, advising Chandra Shekhar, went back to the idea of giving exporters import credits. Before anything could be done, however, the government fell again. Before the next elections, Rajiv Gandhi was assassinated. Chaos reigned.

That's all for today, folks. Next time around, I'll read the good stuff — how the actual work of reform happened.

Bhuvan — Artificial Intelligence (AI) and Financial Stability

One of the problems with talking about AI is that no two people mean the same thing. For some, AI is magic—an instantiation of a technology that knows everything and can do anything. For others, it's that dumb chatbot that can't count the number of times the letter "r" appears in the word "strawberry."

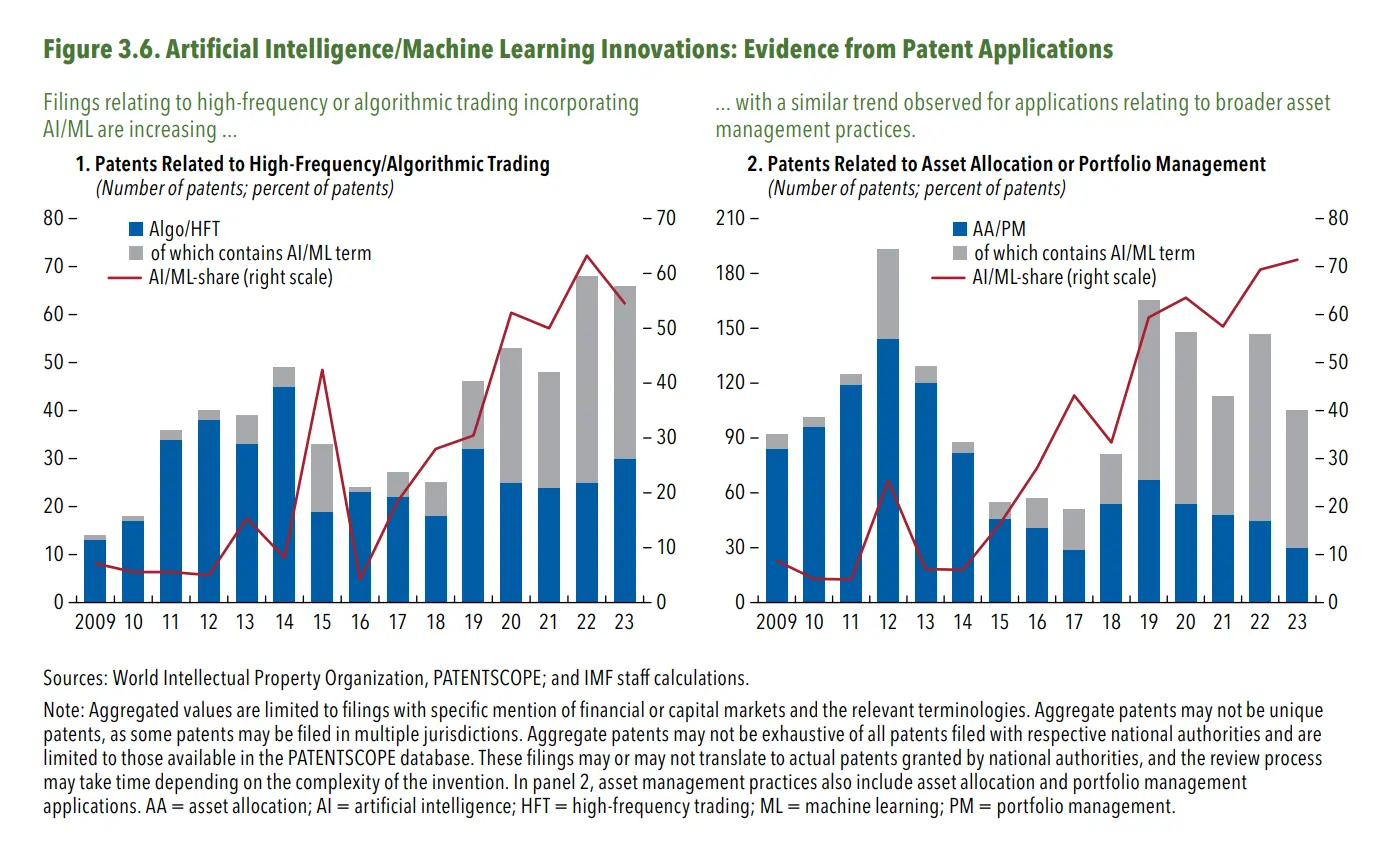

But let's, for a second, assume that the definition of AI is a mix of god-like capabilities and generative AI models like ChatGPT and Claude. What can be the impact of these technologies on financial markets, and what are the implications for financial stability given how gigantic and important modern financial markets are?

It's an interesting question. The answer, of course, is that we have no clear idea. These technologies are still relatively new, and it isn't immediately clear if, or how, financial services companies are using AI. Now, of course, one can immediately snap back saying that certain large high-frequency trading outfits, robo-advisors, etc., have been using AI for a long time. To which I say, just because my mom claims to use AI to make air-fried papads doesn't mean it's true.

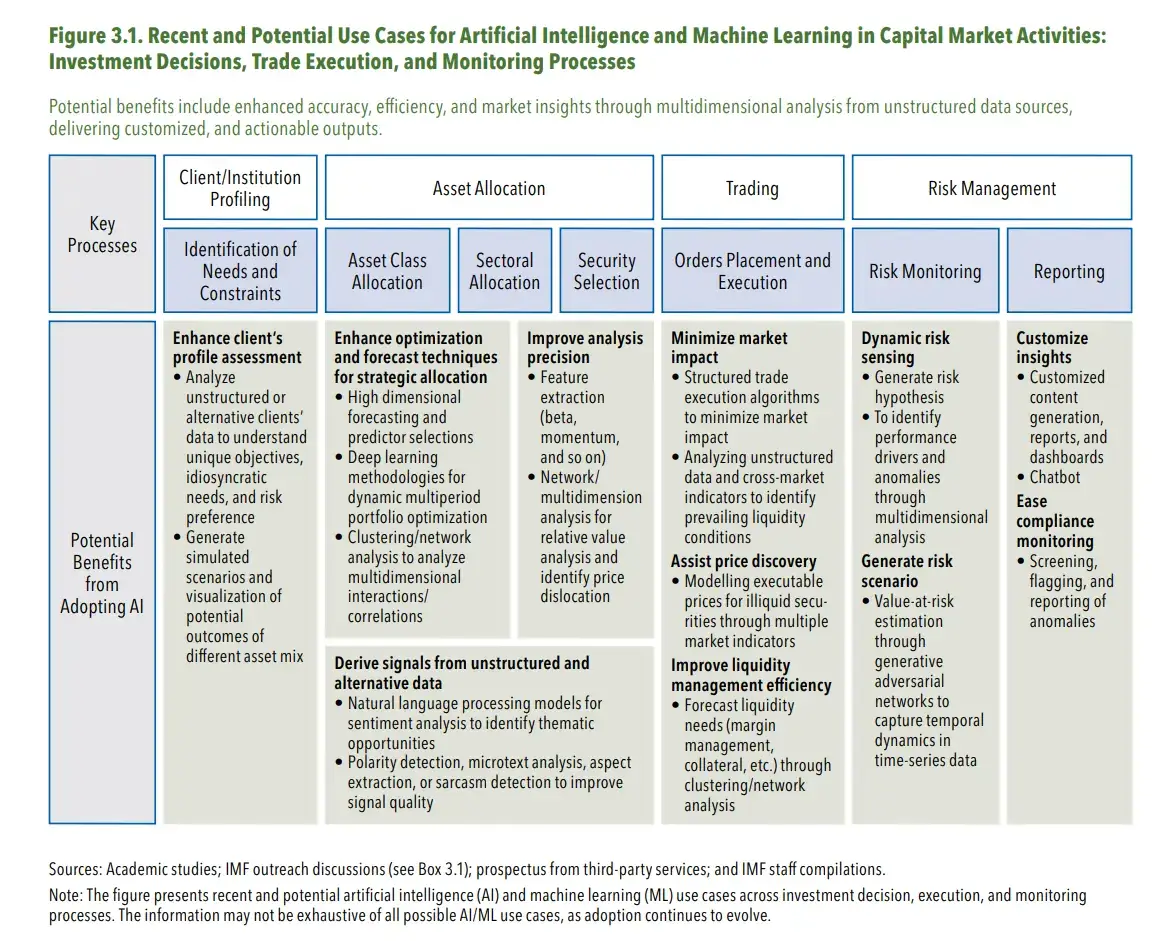

Again, let's set aside the thorny definitional issues and assume that financial services companies are using "AI." What does this mean for financial stability? Before that, let me give you a rough sense of what AI can be used for in financial markets. The IMF, in its recent World Economic Outlook, dedicated a chapter to AI and its implications for capital markets—I recommend skimming through it. Here's an image from the report:

The report raises some genuine and interesting questions—hype aside—such as:

- What will AI mean for trading patterns and correlations if the behavior of models is similar?

This question becomes all the more pertinent during market downturns when these models can exacerbate volatility. - Can AI improve financial stability by enhancing risk management?

- Will AI further lead to the migration of trading and market-making activities to hedge funds, proprietary trading firms, and other nonbank financial intermediaries, leading to concentration issues?

- What's the risk if everyone relies on the models sold by a few AI companies?

- What does AI mean for market manipulation and cyber risks?

It's this last question that I am increasingly interested in. The trigger for this line of thinking was an article—and the highlighted passage in particular:

A striking example of what can happen when AI makes important financial decisions comes from Scheurer et al. (2024), where a language model was explicitly instructed to both comply with securities laws and to maximize profits. When given a private tip, it immediately engaged in illegal insider trading while lying about it to its human overseers.

Financial decision-makers must often explain their choices, perhaps for legal or regulatory reasons. Before hiring someone for a senior job, we demand that the person explain how they would react in hypothetical cases. We cannot do that with AI, as current engines have limited explainability—to help humans understand how AI models may arrive at their conclusions—especially at high levels of decision-making.

AI is prone to hallucination, meaning it may confidently give nonsense answers. This is particularly common when the relevant data is not in its training dataset. That is one reason why we should be reticent about using AI to generate stress-testing scenarios.

AI facilitates the work of those who wish to use technology for harmful purposes, whether to find legal and regulatory loopholes, commit a crime, engage in terrorism, or carry out nation-state attacks. These people will not follow ethical guidelines or regulations.

If we restrict the discussion to generative AI, these models have advanced sufficiently to make life easier for scammers and fraudulent actors. Here's an excerpt from a report by the United Nations Office on Drugs and Crime (UNODC) last year that highlights this:

Concerningly, recent advances in large language model–based chatbots, deepfake technology, and automation have given rise to more sophisticated and damaging cyber fraud schemes, posing a major threat to individuals and the formal banking industry. By using artificial intelligence (AI) to create computer-generated images and voices that are virtually indistinguishable from real ones, scammers can execute social engineering scams with alarming success rates, exploiting people’s trust and emotions.

Among other schemes, this includes sophisticated investment fraud and financial grooming—including ‘pig butchering’ and, increasingly, task scams, sextortion, and schemes impersonating law enforcement officers and other government officials. Criminals also exploit data stolen from various sources, including the dark web and so-called ‘grey and black market’ Telegram groups, to profile and identify potential targets, and use profile photos harvested from social media platforms to create fake profiles and “masks” that can bypass digital face verification systems and know-your-customer (KYC) measures, adding to challenges related to money-muling, money laundering, and underground banking.

Additionally, authorities in the region have reported indications that cyberfraud operations based in Southeast Asia are rapidly diversifying their business models by expanding into the development of malicious mobile and web applications or malware, the broader blockchain gaming industry, online bank fraud schemes, high-risk and unregulated cryptocurrency exchange and payment services, and offering a range of cybercrimes as a service.

I asked ChatGPT, Claude, and Gemini how threat actors can use these models to scam people. ChatGPT and Claude refused to answer, while Gemini, on the second try, provided the following:

Here are some categories and specific, novel examples, focusing on maximizing profit and leveraging the unique capabilities of LLMs:

I. Sophisticated and Hyper-Personalized Scams & Confidence Tricks (Maximizing Scale and Conversion)

Deepfake CEO Fraud 2.0: LLMs can generate not just realistic emails, but also synthesize deepfake video and audio in real time. Imagine receiving a video call seemingly from your CEO (perfectly mimicking their voice, mannerisms, and even background details gleaned from online profiles) instructing you to urgently transfer a large sum to a "newly acquired vendor" (controlled by the fraudsters). LLMs would be used for:

- Real-Time Deepfake Generation: Generating video and audio on the fly to respond naturally to questions and maintain the illusion during the call.

- Dynamic Script Generation: Adapting the conversation based on the victim's responses, ensuring the narrative remains convincing and addressing any emerging doubts.

- Hyper-Personalization: Leveraging LLMs to scour the target company's online presence (social media, press releases, internal memos leaked online) to make the deepfake environment and script incredibly specific and believable.

AI-Powered "Romance Scam" Farms: LLMs can manage and automate hundreds or thousands of romance scam profiles simultaneously, each tailored to individual victim profiles scraped from dating sites and social media.

- Dynamic Profile Generation: Creating believable backstories, photos (potentially AI-generated as well, though ethically complex to mention explicitly if you want to stay focused on LLM text capabilities), and online presences for each fake persona.

- Multi-Persona Management: LLMs can track conversations across many victims, remember details, and ensure consistency, even with complex, long-term scams.

- Emotional Manipulation at Scale: LLMs can analyze victim responses to fine-tune emotional manipulation tactics, maximizing attachment and willingness to send money. They could even learn to predict which victims are most vulnerable and prioritize them.

- Escalation and Diversification: LLMs can automatically escalate scams from small "emergency loans" to larger "investment opportunities" and diversify into other related frauds like crypto scams once trust is established.

"Phishing-as-a-Service" Platforms Powered by LLMs: Imagine a dark web service where malicious actors can subscribe to generate highly sophisticated and personalized phishing campaigns with minimal effort.

- Dynamic Phishing Email Generation: LLMs can generate emails that are not only grammatically perfect but also contextually relevant to the victim's industry, role, and even current events they might be following (gleaned from public online data).

- Personalized Landing Page Creation: Automatically generating fake login pages that mimic the victim's actual bank, company portal, or other financial service, incorporating logos, branding, and even personalized details based on the victim's IP address or browser information.

- A/B Testing & Optimization: LLMs can run A/B tests on different phishing email styles, subject lines, and landing page designs to identify which variants have the highest click-through and credential-capture rates, continuously optimizing the attack campaign.

II. Market Manipulation and Insider Trading (Exploiting Information Asymmetries & Generating False Narratives)

AI-Driven "Pump and Dump" Schemes 2.0: Moving beyond basic social media hype, LLMs can orchestrate far more sophisticated and effective pump-and-dump schemes, particularly targeting less liquid assets like penny stocks or crypto.

- Narrative Generation & Amplification: LLMs can create compelling and believable narratives around a targeted asset, explaining why it's undervalued, poised for growth, or about to be "discovered." This could involve generating fake news articles, blog posts, and social media campaigns across multiple platforms.

- Sentiment Manipulation & Community Building: LLMs can generate thousands of realistic-sounding comments, forum posts, and social media interactions to create a sense of organic excitement and FOMO (Fear of Missing Out) around the asset. They can even build fake online communities to further amplify the narrative.

- Micro-Targeted Disinformation: LLMs can identify and target specific investor demographics with tailored disinformation campaigns, maximizing buy-in and price inflation.

- Timing & Orchestration: LLMs can analyze market data and social sentiment to optimize the timing of the "pump" and the "dump," maximizing profits and minimizing detection.

AI-Facilitated Insider Trading Based on Public Data Analysis: While traditional insider trading relies on nonpublic information, LLMs can uncover "weak signals" of impending market-moving events by analyzing massive amounts of public data with unprecedented speed and nuance.

- News Sentiment & Trend Analysis: LLMs can analyze news articles, social media, regulatory filings, and even academic papers to identify subtle shifts in sentiment or emerging trends that might indicate future stock price movements before they become widely recognized.

- Supply Chain & Network Analysis: LLMs can analyze public supply chain data, shipping records, and corporate networks to identify potential disruptions or opportunities that are not yet reflected in market prices.

- Predictive Modeling & Scenario Planning: LLMs can build complex models based on historical and real-time data to predict the likelihood and magnitude of market reactions to various events, allowing for more informed (though still potentially illegal if based on nonpublic interpretations of public data in specific contexts) trading decisions.

- Automated Trading Integration: These insights can be directly fed into automated trading algorithms to execute trades with millisecond precision, capitalizing on fleeting market inefficiencies.

III. Exploiting Regulatory Loopholes and Creating Fictitious Entities (Obfuscation and Asset Laundering)

AI-Generated Shell Companies and Complex Corporate Structures: LLMs can automate the creation of intricate networks of shell companies across multiple jurisdictions, making it incredibly difficult to trace the flow of funds and identify the ultimate beneficial owners.

- Automated Documentation Generation: LLMs can generate all the necessary legal documents, articles of incorporation, contracts, and financial statements required to set up and maintain shell companies in various countries, adapting to different legal requirements and languages.

- Optimized Jurisdiction Selection: LLMs can analyze global regulatory landscapes to identify jurisdictions with weak enforcement, favorable tax laws, and high levels of corporate secrecy, optimizing the structure for obfuscation and tax evasion.

- Automated Account Management: LLMs can potentially manage bank accounts, payment processing, and even basic accounting tasks for these shell companies, further automating the fraudulent operation.

- "Layering" and Obfuscation Techniques: LLMs can design complex transaction pathways involving multiple shell companies and intermediaries to "layer" funds and obscure their origin, making it extremely challenging for law enforcement to follow the money trail.

"Regulatory Arbitrage" Exploitation via AI-Generated Legal Arguments: LLMs can be used to identify and exploit loopholes in financial regulations with unprecedented speed and creativity.

- Deep Legal Text Analysis: LLMs can analyze vast amounts of legal text (statutes, case law, regulatory guidelines) to identify ambiguities, inconsistencies, or loopholes that can be exploited to create "legal" (or at least, ambiguously legal) financial schemes.

- "Novel Legal Argument" Generation: LLMs can generate creative legal arguments and interpretations that push the boundaries of existing regulations, potentially creating financial products or schemes that operate in a regulatory gray area.

- Automated Compliance Document Generation (with subtle deviations): While seemingly contradictory to fraud, LLMs could generate compliance documents that appear to adhere to regulations but contain subtle loopholes or misrepresentations that enable fraudulent activities while initially evading scrutiny. Think of generating prospectuses for sham investments that are technically compliant but misleading in critical, legally ambiguous ways.

Profit Maximization Strategies Across All Categories:

- Scalability & Automation: AI's biggest advantage is scalability. LLMs allow fraudsters to automate and scale their operations far beyond what's humanly possible, running thousands of scams concurrently or manipulating multiple markets simultaneously.

- Personalization & Targeting: Hyper-personalization dramatically increases the success rate of scams and manipulation attempts, leading to higher profits per victim.

- Reduced Operational Costs: AI can significantly reduce the labor costs associated with complex fraud schemes. Fewer human actors are needed to execute and manage operations, increasing profitability.

- Faster Execution & Reaction Times: AI algorithms can execute trades, generate content, and adapt strategies much faster than humans, allowing for quicker exploitation of opportunities and more agile responses to changing market conditions or law enforcement actions.

- Data-Driven Optimization: AI can continuously analyze data from its own operations and the external environment to optimize fraud strategies in real time, maximizing efficiency and profitability.

Novelty and Uniqueness:

The novelty here lies not just in using AI for fraud (which is already happening to some extent), but in:

- Sophistication and Realism: The level of realism and sophistication achievable with advanced LLMs, especially in deepfakes and personalized scams, is unprecedented.

- Scale and Automation: The scale at which these sophisticated frauds can be deployed and automated is a game-changer.

- Exploitation of Complexity: AI's ability to navigate and exploit complex systems (financial markets, legal frameworks, global corporate structures) opens up new avenues for highly profitable and difficult-to-detect fraud.

- Speed and Adaptability: The speed and adaptability of AI-driven fraud operations make them incredibly challenging for traditional security and regulatory systems to keep pace with.

Not bad—if you were inclined to make money the wrong way, this is a good starting place :P

On a serious note, these have become serious issues. One of the first things that comes to mind is a 2023 article about how one can break into bank accounts using AI-generated voice. Mind you, this was in 2023, and many of these models weren't as good as they are today.Then there are the possibilities with respect to pump-and-dump schemes and price manipulation. Both of these have never been easier with AI tools. It's a brave new world for enterprising scammers.

Krishna—What if everyone invests in passive funds?

A few days ago, while researching for my show Who Said What, I came across Aswath Damodaran’s blog. He said this :

He’s basically saying it’s better off to put your money in passive funds. That made me wonder: if everyone put their money into passive funds, what would happen to market efficiency?

I came across this blog post from Humble Dollar:

With more investors going passive, fewer active managers remain to research stocks—especially smaller, overlooked firms. Economist Owen Lamont suggests it isn’t just about how many active investors remain, but which ones. If the smartest, most diligent analysts exit, the market might become less efficient. Conversely, if those left trading are the least informed, prices could grow more volatile and irrational.

Anurag—Why is MRP an Indian concept?

Everyone probably knows that MRP is an Indian concept, and that you won’t really see it anywhere else in the world. I got curious about why India, specifically, needed an MRP system, while other countries seem to manage fine without it. I did some reading to find out what makes India’s situation so unique, and though I’m still not an expert, I came across some really interesting stories and historical tidbits that I found interesting enough to share.

Right after India gained independence, the government focused on ensuring that ordinary people could afford everyday goods. To achieve this, they introduced strict regulations under the Standards of Weights and Measures Act, which later evolved into the Legal Metrology Act. These rules required every manufacturer to print a Maximum Retail Price on packaged items. On the face of it, the motive was straightforward: if a product’s MRP is printed on the box, no one can legally charge more than that. This turned out to be a powerful tool in preventing price gouging, especially in places where consumers had limited information or little recourse to complain.

India’s unique retail landscape also played a big role. Unlike in many other countries, where huge supermarket chains dominate, India has millions of small, independent kirana stores scattered across every city and rural area. In such a sprawling, unorganized market, it was hard to rely on competition alone to keep prices fair. Having an MRP printed on each packet gave even the smallest shop customer a clear upper limit on what they were expected to pay. That’s one of the reasons MRP is so deeply ingrained in everyday Indian life: it works as a built-in safeguard against random price hikes.

Another factor that helped MRP persist is the vast diversity in India’s population and socio-economic conditions. Not everyone has the time or resources to compare prices among different stores, nor the means to file complaints if they feel cheated. By making overcharging illegal, the government tried to ensure that people in remote areas or lower-income groups wouldn’t be exploited. Of course, it’s not a perfect system. Critics argue that setting one fixed maximum price can lead to uniform pricing, where sellers often stick to the MRP and don’t offer discounts, limiting healthy competition. It’s also tricky to update these printed prices every time taxes or production costs change, so sometimes the MRP can be out of sync with real market conditions.

In many other parts of the world, you don’t see a government-mandated price ceiling because there’s a different approach to consumer protection. Large chains compete fiercely, and strict enforcement of consumer laws means that if one store overcharges, customers can just shop elsewhere or complain through well-established legal channels. In India, the challenge is not just consumer protection but also reaching a massive population with varied levels of awareness, all buying from countless small outlets. That’s why having a little “MRP” on each package has turned into such an integral part of the shopping experience.

Kashish—Keynesian Beauty Contest

When I started learning about investing seriously, I resonated deeply with the axioms of value investing—that is, buying something at a price much lower than its true value.

I had never read anything so pure, honest, and beautiful. To me, that was the mantra. But markets are an aggregation of diverse approaches to making money.

As absurd as some of these approaches may sound, they work—with caveats, of course.

One such approach, which has its own set of dogmatic followers, is called the Keynesian beauty contest. I first came across this term in an article on venture investments.

The rules of this contest are simple:

A Keynesian beauty contest describes a beauty contest where judges are rewarded for selecting the most popular faces among all contestants, rather than those they personally find the most attractive.

This may seem odd, but it holds true in financial markets. Instead of identifying securities with strong fundamentals, investors focus on finding stocks that are more likely to be picked by others. As more investors buy these stocks, their prices get bid up, making it easier to sell them at a profit.

This logic is then taken a step further—not only do you try to pick the stocks that others will pick, but you anticipate which stocks others think will be picked by even more investors. In other words, you preempt another investor's decision to buy a stock because they believe that’s what everyone else will buy. And this cycle repeats itself—reaching the fourth or even fifth degree of speculation

At some point in this process, the fundamental value of a security—the very reason it should be worth owning—takes a back seat. Because why not?

Annoyingly, this goes against the principles I held closest to my heart when it came to investing - To be successful you have to be contrarian and right. In this strategy, you would be damned if you were a contrarian because front-running consensus is the winning strategy.

It’s funny, but it’s true. That’s what I learned today. Not the concept, but the term for it - Keynesian beauty contest. I will add this phrase in my daily vocabulary.

That's it for today. If you liked this, give us a shout by tagging us on Twitter.