Bhuvan—The fallout from Trump's stupid trade war

I haven't written anything apart Trump's tariffs or geopolitics for a very long time. That's because it's probably the only thing that matters right now, considering the world-historic significance of what's happening.

Even though there is a pause in escalation, it doesn't mean this stupid trade war, as I like to call it, is over. We have absolutely no clue what's going to happen next. Trying to guess what's going to happen is a fool's errand. What we can do, however, is try to make sense of the current moment based on what we know, rather than predict things—because there's absolutely no way to predict the actions of an administration that styles itself on unpredictability.

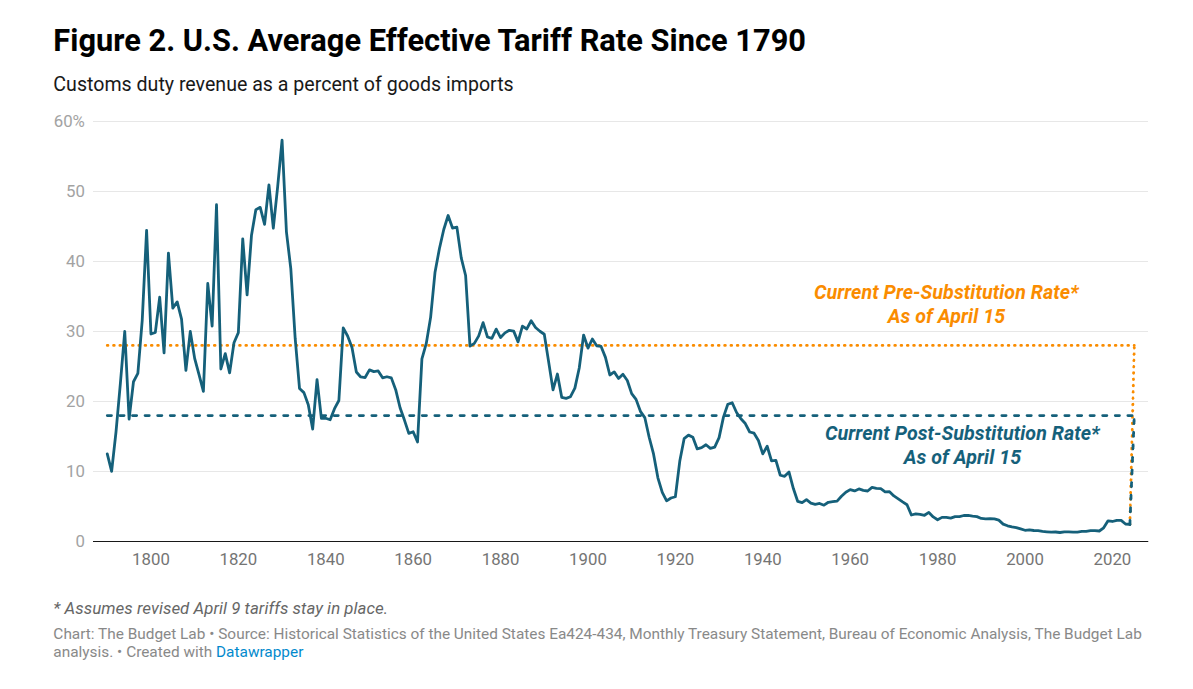

I'm writing this the day after tariffs on China increased to absurd levels. It's ridiculous beyond the point. Once you reach the 80% tariff mark, does it really matter if the tariff is 100%, 200%, 300%, or even "infinity plus one"? I don't think so.

The Unprecedented Decoupling

What's shocking to me—and what's not being discussed enough—is the spectacular decoupling of the United States and China. These are two of the largest economies and among the largest trading partners in the world. Right now, they're engaged in a rising tariff war, with both imposing triple-digit tariffs on each other.

I don't know the entirety of trade history, but I'm pretty sure that if you investigate the vast sweep of human commercial interactions, there's never been an event that comes even close to this utterly devastating situation we're in. In a post a few days ago, I wrote about trying to understand not just the first-order impacts, but the second and third-order effects.

What makes analysis difficult is that we have absolutely no certainty about future actions, which makes uncertainty the default. The only thing certain is that we don't know the real damage this will cause. Nevertheless, stories are starting to trickle in about the impact of these tariffs, and they're just depressing.

A Bizarre Political Alignment

One of the more ironic things Trump has managed to do is unite people on both the left and right on the virtues of free trade. I never thought I'd live to see a day when people on the extreme left retweet articles, graphics, and data from the Cato Institute—the home of libertarian thinking, small government advocacy, and unfettered free trade.

I've been unable to stop laughing at this curious convergence. But beyond that, I've been trying to listen to experts on trade across the spectrum, absorbing various perspectives to make sense of this utterly nightmarish moment we're living in.

Trade as a Human Instinct

Let's remember that trade is a natural state of human existence. I haven't studied all of trading history, but I'm confident we've been trading for as long as humans have existed. Perhaps the first trade was "I have coffee, you have sugar, we both have a little extra, so why don't we exchange?" And thus, the morning ritual of coffee with sugar was born. I'm making that up, but nonetheless, trade is deeply human. There's something hardwired in all of us about the instinct to trade. I don't think that's going to change.

The Destruction of Business Predictability

The second shocking element of this entire stupid trade war was highlighted by Ryan Petersen, founder of the logistics platform Flexport. To give you a sense of why you should pay attention to Ryan Petersen: Flexport is a logistics platform through which approximately 1% of the entirety of United States trade passes. So they have a bird's-eye view of global trade. Even though 1% might seem small, it's not a small number in absolute terms.

Petersen appeared on Azeem Azhar's podcast (Azeem is the author of "Exponential View," both the newsletter and book by the same name). He said something shocking that stuck in my head: people have built their entire businesses on the predictable bedrock of rules and norms that were developed over 2-3 decades. All of that has been yanked away and destroyed in a matter of days. He also predicted widespread bankruptcies.

Evidence of Tariff Damage

What does he mean by that? Let me highlight some evidence we have about the destructive impact of tariffs:

The Tax Foundation, a non-profit organization, has assessed that Trump's tariffs will lead to an average tax increase of $1,300 per U.S. household.

The Penn Wharton Budget Model predicts that middle-income households will face a spectacular $22,000 in lifetime losses if tariffs continue.

One estimate indicates that a 25% increase in auto tariffs will cost U.S. consumers $30 billion in increased vehicle prices.

Other analyses predict falls in GDP growth, rises in inflation, and drops in consumption.

The reason I'm pointing to all these predictions and analyses is not because they are carved in stone, but because they give you a sense of the damage that Trump's tariffs will unleash if this stupid trade war continues. The idea is not to focus on the granularity of the numbers or the accuracy to the second decimal place, but to provide a directional sense of impact.

These figures also demonstrate the spectacular loss in income that Americans will experience. While wealthy households might be able to absorb these costs, poor and middle-class families will be devastated by this economic shock.

Real-World Impact on Small Businesses

Perhaps some of the stories that stuck with me most were related to small businesses. I've been reading reports indicating that companies are outright canceling their orders from China because they have absolutely no certainty about what's going to happen next.

When you have triple-digit tariffs—whether it's 100%, 200%, or more—it doesn't really matter. I don't think most businesses can survive that level of increase in tariffs and still remain viable.

Let me share some concrete examples:

According to the Associated Press, there's an educational toy manufacturing company in Chicago that has been a family business for three generations. The CEO had prepared for 20% to 40% tariffs by adjusting prices, shipping, and supply chains. But now, with tariffs jumping to 145%, his tariff bill will go from $2.3 million in 2024 to a staggering $10 million in 2025. That's simply unsustainable. And this calculation was based on 145% tariffs—after the article was published, tariffs on Chinese goods imports increased further to 245%. There's absolutely no way a small business like this will survive triple-digit tariffs.

Another owner of a small online stationery business reported that the tariffs would have a devastating impact, costing her business an additional $630,000 in fees over the next year alone.

The owner of another small business that imports and sells toys from China put it bluntly: "In two months, I'll probably shut down."

These are just a few of the numerous stories emerging where small businesses—which had spent years or decades building up operations by relying on affordable imported goods from China—are suddenly facing the threat of bankruptcy because tariffs have increased by a spectacular amount.

The worst part is that these are all small, individual entrepreneurs who run "mom and pop" businesses with just one to ten employees. American workers, members of local communities, will probably be out of job if this tariff situation doesn't improve. And it's not just small businesses—these tariffs are hitting businesses and consumers across the board.

Ryan Petersen: I mean, they're pretty pissed off. They're people who built businesses over a decade playing under the rules of the game as it was defined. I mean, you know that is the job of the government—define the rules, and then the business people have to find a way to make money, whatever those rules might be. But having those rules changed out from under you with no notice overnight... I mean, you had some notice, people knew that some things were going to happen here, but it takes time to shift a supply chain, to make decisions, etc. So, yeah, people are pretty pissed off. Some are in despair, some realizing, 'Hey, you know, you built your whole life, built your whole career around this company, and now all of a sudden, maybe your business model doesn't work.' And what are you going to do? It's pretty terrible.

The Double (and Triple) Taxation Problem

Ford is already warning its dealers that prices will go up. In a spectacular display of economic misunderstanding, both inputs into automotive manufacturing and completed cars are being taxed.

As Scott Lincicome of the Cato Institute has pointed out, 50% to 60% of all U.S. imports are intermediate goods—which means they go into the making of something else. When you tax intermediate goods, the prices of the finished products must increase. This creates a double taxation effect: on one hand, the inputs are being taxed; on the other hand, consumers will pay more for the final product because manufacturers must pass along the higher input costs.

To make matters even worse, if a U.S. company decides to export its finished product, it will likely face retaliatory tariffs from other countries. So in effect, there are three layers of taxation happening. This illustrates the spectacular shortsightedness of these tariff policies.

It's also important to recognize that imported finished goods are often inputs for other businesses. Perhaps one of the most distressing examples of consumer impact is that everything from diapers, baby toys, baby monitors, strollers, cribs, blankets, clothes, shoes, car seats, and other child-related items will increase in price—because nearly all of these baby-related items are imported from China. Soon we'll have parents across America feeling the financial strain of these policies.

American Farmers: Trump Supporters Taking the Hit

Another constituency that's been hit particularly hard by Trump's tariffs is American agricultural producers, especially soybean farmers—many of whom are hardcore Trump supporters.

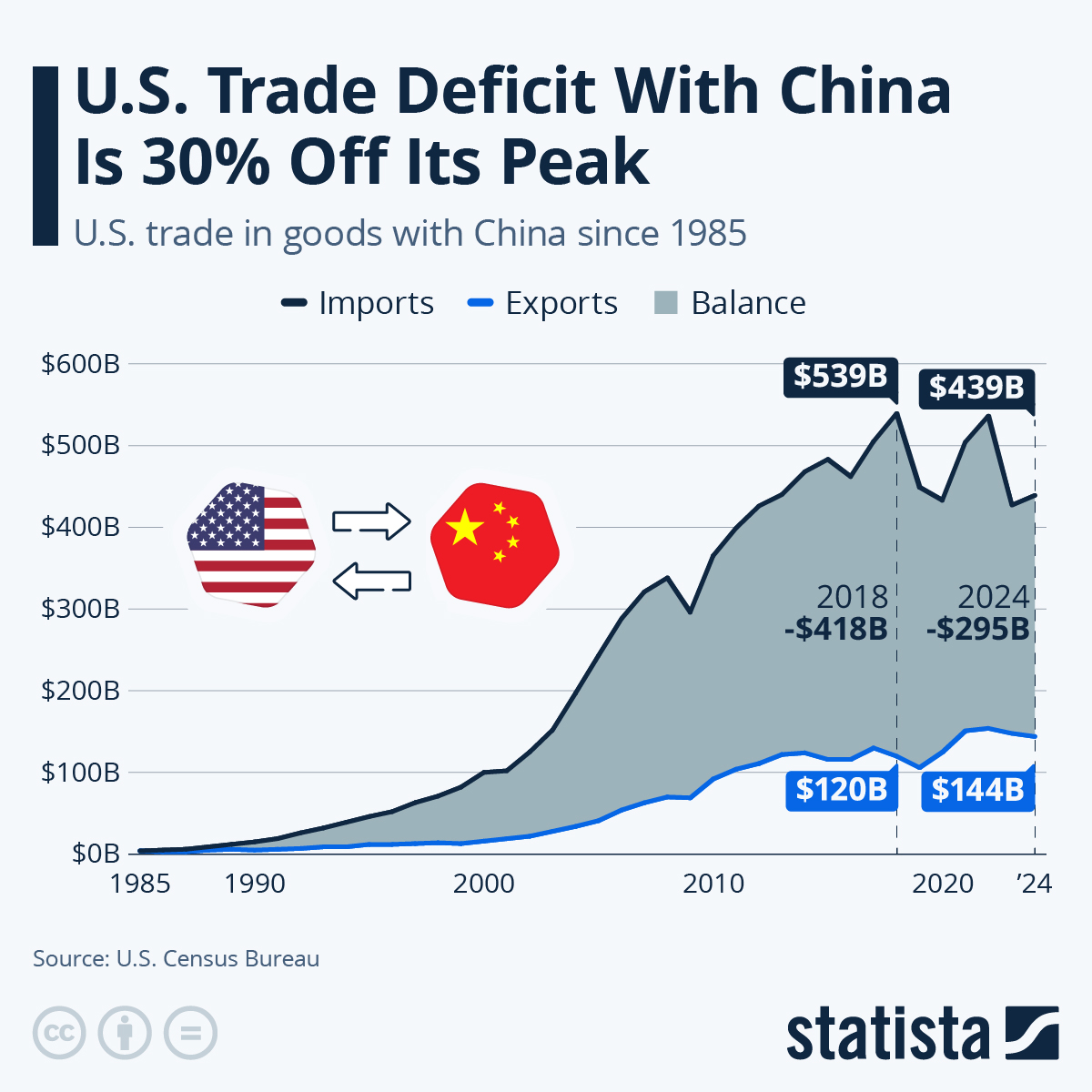

According to an article in The Dispatch: "The situation they are facing is much more dire than in 2018."

I dug deeper into the impact on farmers, and it's genuinely depressing. During Trump's previous trade disputes in his first term, export losses totaled more than $27 billion. And 71% of that $27 billion in lost value was in soybeans alone. Soybean exports to China didn't just fall—they crashed—from $14 billion to $3 billion. That's nearly an 86% decline.

As a result, China shifted its soybean purchases to Brazil. According to some estimates, American farmers' incomes as a share of the Chinese market never fully recovered to pre-trade war levels.

Adding to farmers' woes, tariffs on Canadian fertilizers will push up the price of potash. The same applies to agricultural machinery, which will increase the price of farm equipment. The very people who enthusiastically voted for Trump are now being utterly and devastatingly impacted by his trade policies.

Inefficiencies and Market Distortions

Beyond the direct price effects, this tariff war will lead to all sorts of market inefficiencies. On Azeem Azhar's podcast, there was a discussion about how components like graphics cards would be affected, creating distortions throughout the technology supply chain.

For example, GPUs (graphic processing units) themselves are duty-free. But graphics cards, which include GPUs, are not exempt from tariffs. This creates a bizarre situation where electronics companies will have to import components separately and then assemble graphics cards in the US—adding the GPU, PCB, memory, etc., domestically rather than importing the finished product. This leads to inefficient assembly processes that add unnecessary costs and complexity.

You can imagine this playing out on a much grander scale. If there are tariff exemptions for US allies like Vietnam, while tariffs continue to apply to China, we'll likely see a repeat of what happened during Trump's first round of tariffs: Chinese companies shifting manufacturing wholesale to Vietnam and Mexico to backdoor entry into the United States.

But there's another layer of complexity here. As Ryan Petersen pointed out in that podcast, even though some products might be assembled in Vietnam or Mexico, the supply of parts still comes from China. Countries like Vietnam and Mexico that are moving up in global supply chains don't yet have the capabilities to manufacture high-end components required for many finished goods. So even though a product might ostensibly be "manufactured in Vietnam," the industrial clusters that supply the components are still heavily based in China.

There are also agglomeration effects to industrial clusters because of the diffusion of innovation in these ecosystems. You can't simply cajole one supplier to relocate wholesale to the United States. There are scale benefits, location benefits, and intangible learning that happens within these clusters because they all supply to the same end buyers. This is far more complicated than most people assume.

The Future of Global Trade

What does all this mean for global trade? Interestingly, Ryan Petersen thinks that trade might actually increase overall. I'm not sure about that prediction, but what does seem clear is that trade won't stop—it's just too deeply human.

If these tariffs continue and the trade war escalates, it will lead to all sorts of weird and utterly pointless inefficiencies in global trading systems and supply chains. But that doesn't mean trade will grind to a halt. As long as one country has something another country needs, trade will not only continue but will find ways to flourish.

If the United States doesn't see the error of its ways, this will lead to alternative arrangements. Ultimately, trade is like water—it will flow where it needs to, one way or another. You can try putting up dams and barriers, but it will find ways to flow downhill.

Should this continue, the United States, despite being the largest consumer market, may find itself increasingly isolated. Companies will adjust to a new reality where one large consumer market is difficult to access. Countries will find new configurations and arrangements that better serve their interests, potentially leaving America on the outside looking in at new trading blocs and partnerships.

Conclusion

The spectacular decoupling between the United States and China represents one of the most significant disruptions to global trade in modern history. The impacts are already being felt by small business owners, farmers, manufacturers, and ultimately will reach every American consumer.

What makes this situation particularly tragic is that it's essentially self-inflicted economic damage. The purported benefits—bringing manufacturing jobs back to America, reducing dependence on China, improving the trade balance—are unlikely to materialize in any meaningful way. Instead, we're seeing businesses facing bankruptcy, consumers preparing for higher prices, and global supply chains being warped into less efficient configurations.

As we watch this unfold, it's worth remembering that economic policy shouldn't be governed by impulse or political theater. The consequences are far too serious for millions of people's livelihoods. The tariff war may satisfy certain political instincts, but the economic reality it creates will be painful for years to come.

That's it for today. If you liked this, give us a shout by tagging us on Twitter.